Warren Buffett Reveals How Most Live Better Than Rockefeller — 3 Wealth-Building Tips

Understanding Wealth and Financial Security

The concept of wealth is often subjective, but it's essential to understand what it truly means to be considered "rich." According to Bloomberg, an annual income of $175,000 places you in the top 10% of tax filers, which statistically qualifies you as wealthy. However, this figure doesn't always align with personal perceptions. In a 2023 survey, 25% of individuals earning that amount or more described themselves as “very poor,” “poor,” or “getting by, but things are tight.” Half of them said they’re only “comfortable” at best.

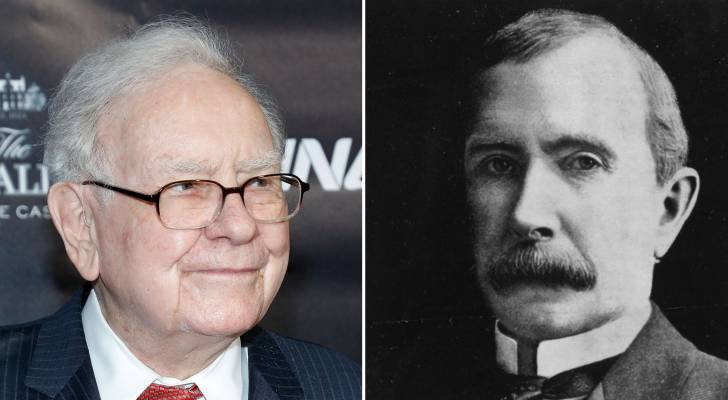

This discrepancy highlights how financial stability can vary widely depending on individual circumstances and expenses. With rising costs for everything from cars to condos, many Americans might be underestimating their real net worth. Warren Buffett has pointed out that even the bottom 5% of income earners in the U.S. today live better than John D. Rockefeller did when he was the richest man in the world. Modern advancements in medicine, education, entertainment, and transportation have significantly improved quality of life.

Stable Investments Over Riskier Bets

When it comes to building wealth, stable investments often outweigh riskier bets. A recent Bank of America survey found that individuals aged 21 to 43 with at least $3 million in assets only have 25% of their portfolio invested in stocks. However, 93% of these young millionaires plan to allocate more of their portfolio to alternatives in the next few years.

Alternative investments such as gold have gained popularity among wealthy young investors. The survey revealed that 45% own gold as a physical asset, and another 45% are interested in holding it. Gold is often seen as a safe-haven asset, especially during times of economic uncertainty. Its value is not affected by inflation in the same way as fiat money, making it an effective hedge against market volatility.

Investing in gold can also offer tax advantages through a gold IRA. These accounts allow investors to hold physical gold or gold-related assets within a retirement account, combining the benefits of tax-deferred growth with the security of precious metals. For those interested in exploring this option, there are resources available that provide information on how to get up to $10,000 in free silver on qualifying purchases.

Social Media and Financial Perceptions

Social media plays a significant role in shaping how people perceive wealth. A 2025 study by Soax found that 73% of Americans use some form of social media. While finance influencers offer various opinions on wealth-building strategies, social media often focuses on showcasing luxury lifestyles rather than the realities of debt and mortgages. This can lead to unrealistic expectations and financial comparisons.

Professional financial advisors can help individuals gain a clearer understanding of their financial standing. Services like Advisor.com connect users with qualified professionals who can create personalized financial plans. These advisors can assist in setting realistic goals and navigating the complexities of investing.

Long-Term Investing and Patience

Patience and long-term thinking are crucial in wealth-building. Warren Buffett emphasized the importance of reading and understanding the stock market, mentioning his experience with Moody's Manual, a detailed resource on publicly traded stocks. Constantly checking investment portfolios can lead to unnecessary stress and short-sighted decisions.

Compounding interest is a powerful tool that can grow even small amounts over time. Apps like Acorns simplify the process by automatically investing spare change into a diversified portfolio. With as little as $5, users can start investing, and signing up today may include a $20 bonus to help kickstart their journey.

Conclusion

Understanding wealth involves more than just income levels; it includes evaluating personal financial situations, considering long-term goals, and making informed investment choices. By focusing on stable investments, seeking professional advice, and maintaining a long-term perspective, individuals can work toward achieving financial security and building lasting wealth.

Post a Comment for "Warren Buffett Reveals How Most Live Better Than Rockefeller — 3 Wealth-Building Tips"

Post a Comment