UnitedHealth Plummets Post-Q2 Surprise: Panic or Opportunity?

UnitedHealth Group's Recent Struggles and Market Reaction

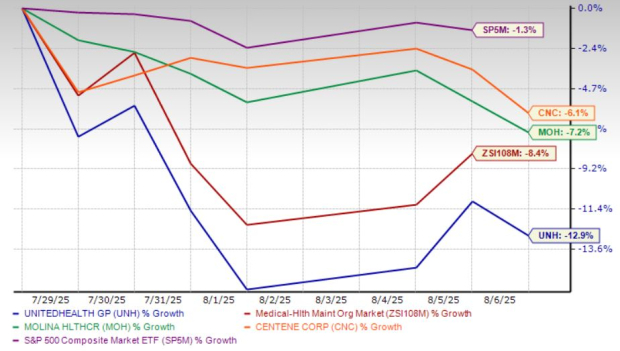

UnitedHealth Group Incorporated (UNH) has experienced a significant downturn, with its stock price falling by 12.9% following the release of disappointing second-quarter 2025 results and a sharp reduction in its full-year earnings forecast. This decline has had a ripple effect across the managed care sector, impacting companies such as Molina Healthcare, Inc. (MOH) and Centene Corporation (CNC). The market's response highlights growing concerns on Wall Street regarding the challenges of predicting rising medical costs and their impact on insurer profitability.

A Series of Challenges for UnitedHealth

In recent months, UNH has faced a series of setbacks that have further contributed to its struggles. These include a major cyberattack, the tragic killing of a senior executive, two consecutive quarters of weak earnings, a sudden CEO transition, and ongoing investigations by the Department of Justice (DOJ). As a result, the company is now trading near its 52-week low of $234.60, raising questions about whether it presents a compelling investment opportunity.

Performance Analysis of UNH, MOH, and CNC

The performance of UNH, along with its peers MOH and CNC, has been closely monitored against broader market indices like the S&P 500. While revenues for UNH rose by 12.9% year over year to $111.6 billion, adjusted earnings per share fell short of expectations, coming in at $4.08 compared to the Zacks Consensus Estimate of $4.84. This marked a steep 40% decline from the previous year, driven primarily by higher-than-expected medical costs. The company's medical care ratio (MCR) increased to 89.4%, indicating a smaller portion of premiums remaining after paying claims.

Financial Outlook and Valuation Concerns

Despite the recent price decline, UNH's valuation remains relatively high compared to its industry peers. It trades at a forward P/E ratio of 13.24X, which is above the industry average of 12.12X. In contrast, Molina Healthcare and Centene appear more reasonably valued, with forward P/E multiples of 7.78X and 9.72X, respectively. Analyst sentiment has also deteriorated, with multiple downward revisions to 2025 and 2026 earnings estimates, signaling growing skepticism about the company's ability to sustain profit growth.

Regulatory and Legal Risks

Beyond financial performance, UnitedHealth faces increasing regulatory and legal risks. The company is under investigation by the DOJ over potential Medicare billing issues, which could lead to fines or clawbacks. Additionally, its pharmacy benefit manager (PBM), Optum Rx, is facing scrutiny over drug pricing transparency. Regulatory changes, such as President Trump’s “most-favored nation” executive order, could further challenge the role of PBMs by promoting direct drug pricing for consumers.

Potential for Recovery and Long-Term Prospects

Despite these challenges, UnitedHealth maintains a dominant position in the healthcare sector, supported by its scale, diversification, and extensive customer base. Management has taken steps to address current headwinds, including appointing a new CFO and investing in AI and digital technologies to improve operational efficiency. Future tailwinds, such as expected Medicare Advantage rate increases in 2026, could provide margin relief. Additionally, continued growth in self-funded commercial plans and structural trends in healthcare spending may support long-term recovery.

Dividend and Shareholder Returns

UnitedHealth has maintained its commitment to returning capital to shareholders, distributing $4.5 billion in dividends and buybacks in the second quarter alone. In June, the company also raised its quarterly dividend by 5%, reflecting confidence in its long-term cash flow generation capacity.

Should Investors Buy the Dip?

While UnitedHealth's size and market leadership have historically justified a premium valuation, the current environment presents significant challenges. The sharp earnings misses, reduced guidance, and declining operating cash flow expectations indicate deeper structural issues. With margins under pressure, regulatory scrutiny intensifying, and analyst sentiment turning negative, there is limited visibility into a sustainable recovery. Until medical cost trends stabilize and regulatory clarity improves, the risk associated with investing in UNH at this point remains high.

Post a Comment for "UnitedHealth Plummets Post-Q2 Surprise: Panic or Opportunity?"

Post a Comment