Intuitive Surgical Dips Despite 'Solid' Results. Da Vinci 5 Under Scrutiny.

Intuitive Surgical's Stock Volatility Amid Strong Q2 Performance

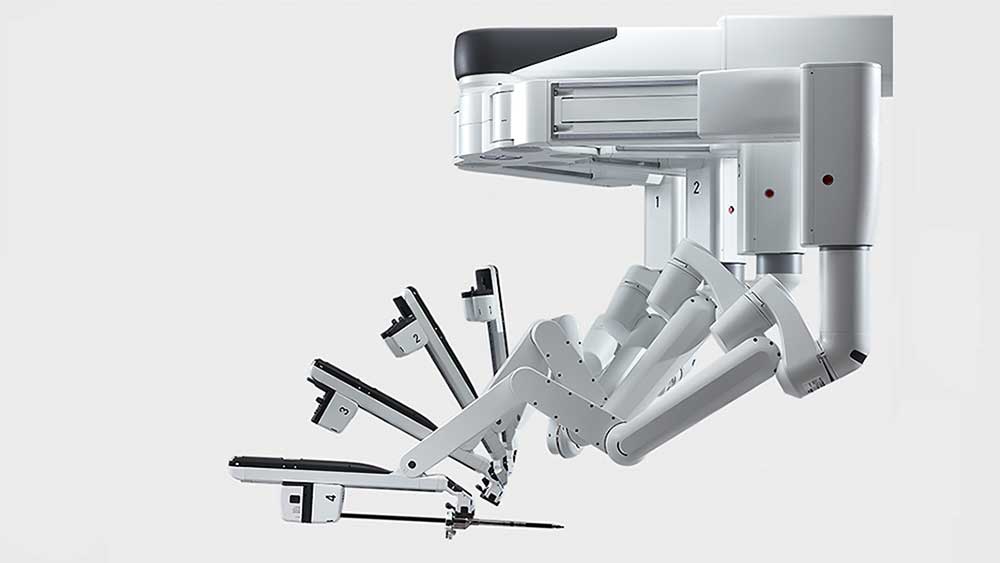

Intuitive Surgical (ISRG) experienced significant stock price fluctuations on Wednesday, despite releasing a "solid" second-quarter report. The company's latest da Vinci 5 robotic surgery system is gaining momentum, but investor sentiment remains mixed.

On the day of the report, Intuitive Surgical shares closed down 1.8% at $501.95. However, earlier in the trading session, the stock had risen as much as 3.8%. These movements followed an after-hours sell-off on Tuesday, which occurred after the company raised its outlook for the year. Despite this positive guidance, the firm still anticipates a slowdown in procedure growth by 2025.

Strong Financial Results and Analyst Praise

Analysts highlighted several positive aspects of the quarter. Mike Kratky, an analyst from Leerink Partners, noted that there was "plenty to like about the quarter." Intuitive Surgical reported adjusted earnings of $2.19 per share on $2.44 billion in sales, representing a 23% and 21% increase compared to the same period last year. Both profit and revenue exceeded analysts' expectations, with earnings beating forecasts by 14% and sales by 4%.

The company also saw a 17% growth in procedures performed using the da Vinci system, aligning with estimates. Kratky expressed optimism about the company's future, stating that Intuitive Surgical has multiple ongoing growth drivers that could help maintain its momentum. He raised his price target for the stock to $593 from $587 and maintained his outperform rating.

Da Vinci 5 Launch and Market Expectations

Investors are closely monitoring the launch of the da Vinci 5 system. During the quarter, Intuitive Surgical placed 395 systems, a 16% increase year over year. Of these, 180 were the newer da Vinci 5 models. While some investors may have hoped for a slightly larger beat in total system placements, particularly in international markets, the company's performance remains strong.

William Blair analyst Brandon Vazquez pointed out that the number of trade-ins is expected to rise in the coming years as hospitals upgrade to the latest system. This could lead to an increased supply of refurbished Xi systems, which can be sold into more cost-sensitive markets and help counter lower-cost competition.

Mixed Performance with Ion System

Despite the positive trends, the company’s Ion system placements declined by 30% year over year. The Ion system is used for lung biopsies. However, Vazquez noted that this decline is normal for the first quarter, as the system is reaching the middle quartile of adoption. He added that while the placement rate may be more normalized now, the 52% growth in procedures continues to be a key driver for the company.

Vazquez maintained his outperform rating for Intuitive Surgical stock.

Procedure Growth Outlook and Industry Trends

For the full year, Intuitive Surgical expects procedure growth using its da Vinci system to range between 15.5% and 17%. This is an improvement on the lower end of its previous outlook but still represents a slowdown compared to the 17% growth in 2024 and 21% in 2023.

Procedure growth is a critical metric for the company, as higher procedure volumes lead to increased demand for single-use instruments and accessories. Over the past nine years, the average annual growth in procedures has been 17%, including two outlier years in 2020 and 2021. Excluding those years, the average growth rate has been nearly 18% over seven years.

The 2025 guidance suggests a potential flat year or even a slowdown, which could impact future performance.

Financial Guidance and Investor Sentiment

Leerink’s Kratky noted that Intuitive Surgical maintained its gross margin guidance despite a 100 basis-point impact from tariffs. The company also reiterated its adjusted operating expenses growth guidance of 10% to 14%, indicating that Wall Street’s expectations are in line for the second half of the year.

Investor sentiment remains cautious, with many watching how the company navigates the challenges ahead. As the da Vinci 5 system gains traction and the company works to address the slowdown in procedure growth, the path forward will likely shape the stock’s performance in the coming months.

Post a Comment for "Intuitive Surgical Dips Despite 'Solid' Results. Da Vinci 5 Under Scrutiny."

Post a Comment