Cryptocurrency Set to Soar: 5 Strong Picks Amid Regulatory Boost

The Rise of Cryptocurrencies and the Impact on Related Stocks

The cryptocurrency market has experienced a significant upward trend this month, with Bitcoin (BTC) reaching an all-time high of $123,091.61 on July 14. Although it has since stabilized around $118,000, the overall sentiment remains positive. Ethereum (ETH) has also shown strong performance, rebounding sharply and recording a gain of over 57% in the past month.

This surge in crypto prices is largely attributed to positive developments in global trade policies and a reduced fear of a near-term recession in the U.S. economy. Additionally, favorable regulatory changes have played a key role in driving momentum within the cryptocurrency space.

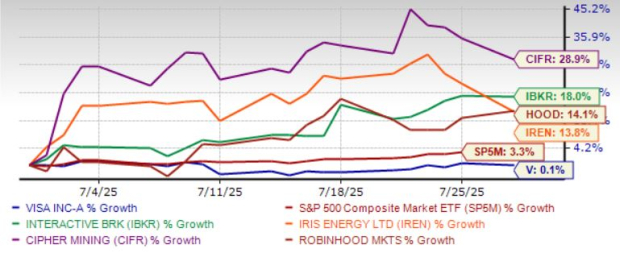

For investors looking to capitalize on these trends, focusing on crypto-centric stocks with a strong Zacks Rank can be a promising strategy for near-term gains. Five such stocks include:

- Robinhood Markets Inc. (HOOD)

- Interactive Brokers Group Inc. (IBKR)

- IREN Ltd. (IREN)

- Visa Inc. (V)

- Cipher Mining Inc. (CIFR)

Regulatory Developments Shaping the Crypto Landscape

On July 18, President Donald Trump signed the GENIUS Act, which aims to regulate the stablecoin market. Stablecoins are digital assets designed to maintain a stable value, often tied to traditional currencies like the U.S. dollar. Major retailers such as Walmart and Amazon are exploring the possibility of launching their own stablecoins to reduce reliance on conventional payment systems.

Two other major crypto-related regulations are currently under consideration: the CLARITY Act and the Anti-CBDC Surveillance State Act. The CLARITY Act seeks to clarify whether cryptocurrencies are classified as commodities or securities, while the Anti-CBDC Surveillance State Act aims to prevent the Federal Reserve from issuing a Central Bank Digital Currency (CBDC) without congressional approval.

These regulatory advancements are expected to provide a more structured environment for the cryptocurrency industry, potentially increasing investor confidence and market stability.

Robinhood Markets Inc. (HOOD)

Robinhood operates a financial services platform in the United States, offering users the ability to invest in stocks, ETFs, options, gold, and cryptocurrencies. Its Robinhood Crypto platform allows users to buy and sell popular cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin.

With increased retail participation in the market, HOOD’s trading revenues are anticipated to grow. The company’s efforts to expand its product offerings and attract active traders are likely to strengthen its financial position. HOOD currently holds a Zacks Rank #1 (Strong Buy), indicating a strong outlook for future growth.

The company is projected to see revenue and earnings growth of 26.8% and 20.2%, respectively, for the current year. Recent improvements in earnings estimates further support its positive trajectory.

Interactive Brokers Group Inc. (IBKR)

Interactive Brokers Group is a global automated electronic broker that offers cryptocurrency trading through its commodities futures trading desk. The company continues to invest in proprietary software, reduce compensation expenses, and expand its presence in emerging markets.

IBKR’s focus on enhancing its product suite and service reach is expected to drive continued revenue growth. The company carries a Zacks Rank #1 (Strong Buy) and is projected to see revenue and earnings growth of 7.4% and 9.7%, respectively, for the current year.

IREN Ltd. (IREN)

IREN is a Bitcoin mining company that focuses on building data center infrastructure in regions with access to renewable energy. The company currently holds a Zacks Rank #2 (Buy), reflecting its potential for growth.

IREN is expected to see substantial revenue and earnings growth of 86.1% and over 100%, respectively, for the current year. Earnings estimates have improved by 17.3% over the last 30 days, reinforcing its positive outlook.

Visa Inc. (V)

Visa is modernizing its digital payment systems, with a particular focus on expanding its stablecoin settlement capabilities to the Solana blockchain. This move is expected to enhance the efficiency of cross-border transactions and strengthen Visa’s position in the digital payments sector.

Visa is projected to see revenue and earnings growth of 10.3% and 13.1%, respectively, for the current year. While earnings estimates have seen a slight improvement of 0.1% over the last 30 days, the company remains a strong contender in the financial services industry.

Cipher Mining Inc. (CIFR)

Cipher Mining is an industrial-scale Bitcoin mining company that also provides high-performance computing services, including artificial intelligence solutions. The company is focused on expanding its power capacity at high-quality data center sites for both Bitcoin mining and HPC.

CIFR is expected to see revenue growth of 72% for the current year, although earnings growth is projected to be negative at -150%. However, earnings estimates have improved by 18.6% over the last 60 days, suggesting potential for recovery.

These five stocks represent a diverse range of opportunities within the cryptocurrency and digital finance sectors, each with unique strengths and growth prospects. Investors should consider their risk tolerance and investment goals before making any decisions.

Post a Comment for "Cryptocurrency Set to Soar: 5 Strong Picks Amid Regulatory Boost"

Post a Comment